Creating Invoices and Purchase Orders

LeapCount offers a streamlined experience for creating professional and visually appealing invoices and purchase orders through an intuitive user interface. This guide will walk you through the key aspects of generating these essential business documents.

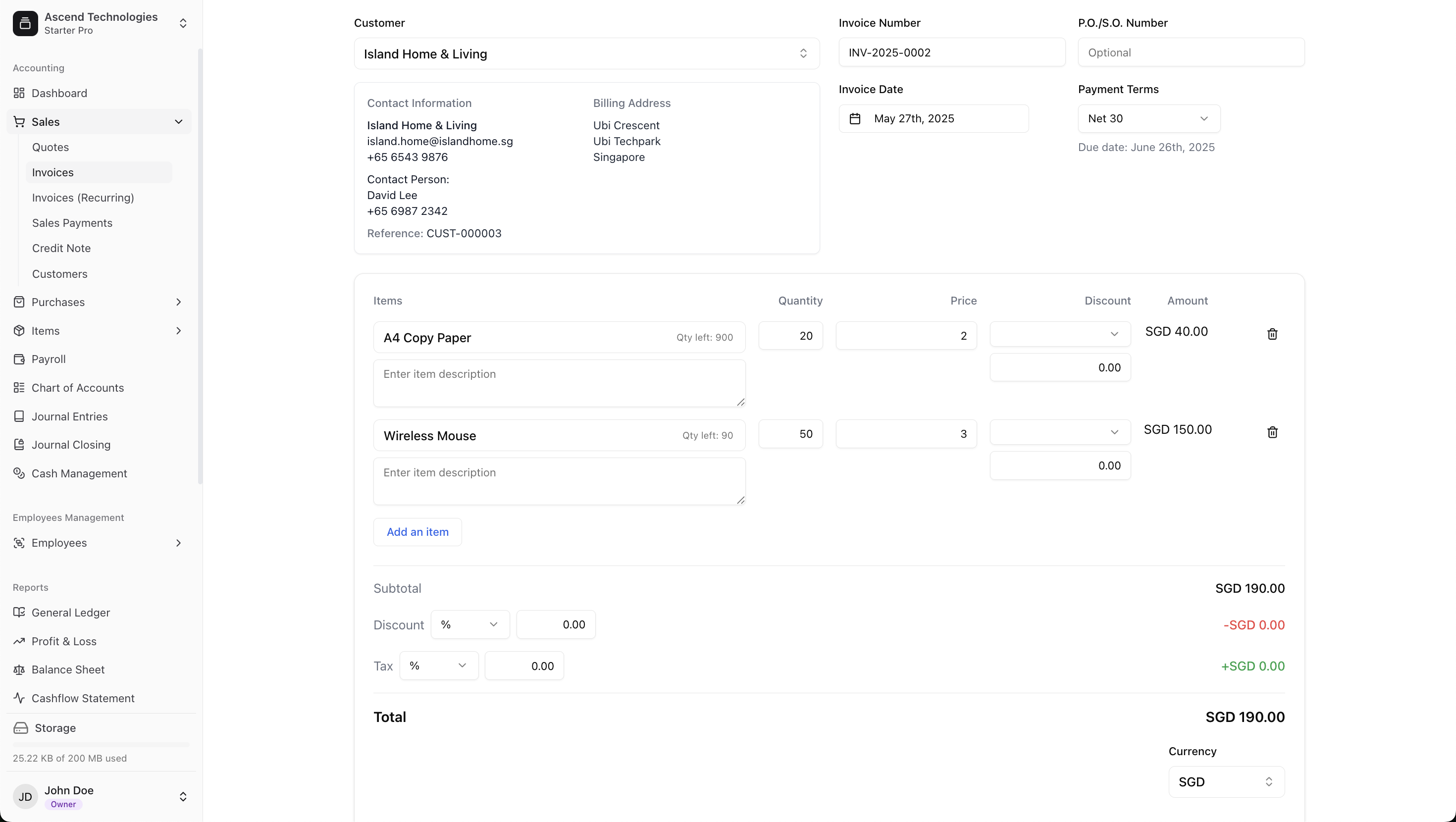

Beautiful Documents with Simple UI/UX

Our goal is to make document creation as effortless as possible. You'll find that:

- Intuitive Design: The interface for creating invoices and purchase orders is designed to be user-friendly, allowing you to quickly add line items, customer/supplier details, and other relevant information.

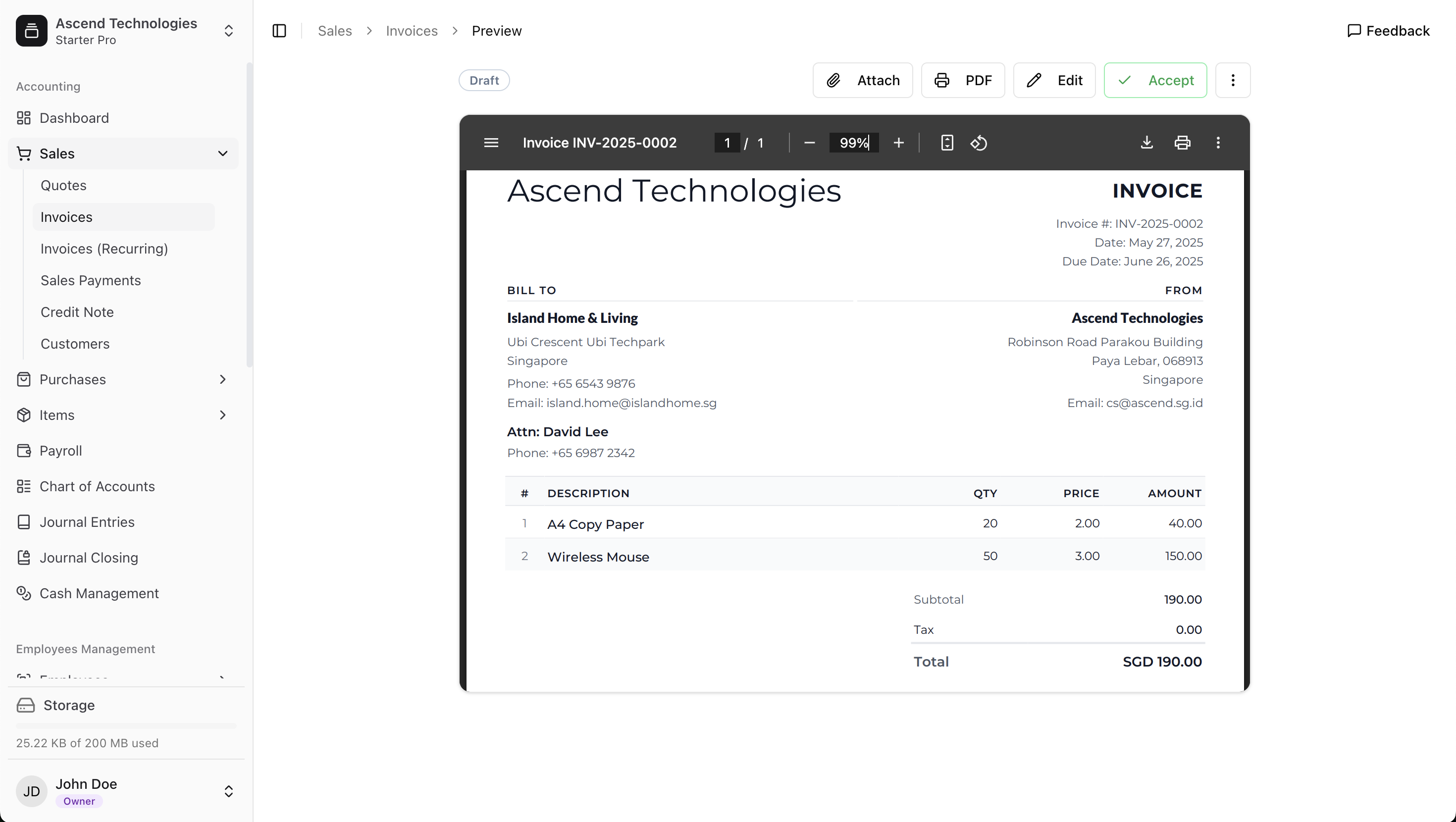

- Professional Templates: Generated documents are well-formatted and present a professional image to your clients and suppliers.

- Easy Customization: While templates provide a great starting point, you can easily adjust details as needed for each transaction.

Key Information and Data Integrity

When you create an invoice or a purchase order, LeapCount captures the relevant information as it exists at that moment. This is important to understand for data accuracy:

Snapshot of Information: Details such as your bank account information (on invoices), customer/supplier addresses, contact details, and item pricing are saved on the invoice or purchase order as they are at the time of creation.

If you later update this information in their respective master records (e.g., change a customer's address in their profile, update an item's default price, or change your company's bank details), these changes will not automatically reflect on previously created invoices or purchase orders.

If an existing document needs to reflect updated master data, you would typically need to create a new version or manually edit the existing (if permissible by its status) document to include the new information.

Document Workflow: Draft and Approval

LeapCount supports a common business workflow for creating and finalizing documents:

- Saving as Draft: You can save an invoice or purchase order as a "Draft" if it's not yet ready for finalization or requires review. Draft documents do not impact your financial ledgers.

- Manager Approval: Once a document is complete, it can be submitted for approval (if your company workflow requires it). A designated manager or user with approval rights can then review the document.

- Approval and Journal Entries: Upon approval of an invoice or purchase order (or bill entered from a PO), LeapCount automatically generates the corresponding double-entry journal entries in your General Ledger. This ensures your financial records are updated in real-time.

- For Invoices: This typically involves debiting Accounts Receivable and crediting Sales Revenue (and Sales Tax Payable, if applicable).

- For Purchase Orders/Bills: This typically involves debiting an Expense or Asset account (like Inventory) and crediting Accounts Payable.

Special Considerations for Physical Items (Invoices)

When adding physical products to an invoice (i.e., selling items you stock):

- Inventory Availability: The system will check if you have sufficient inventory on hand to fulfill the sale. You generally cannot sell items you do not have in stock (unless backorders are specifically configured and supported).

- Cost of Goods Sold (COGS) Calculation: Upon approval of an invoice containing physical products, LeapCount will automatically calculate the Cost of Goods Sold. This cost is determined based on your company's inventory valuation method:

- FIFO (First-In, First-Out): Assumes the oldest inventory items are sold first.

- Weighted Average Cost: Uses the average cost of all units of an item in inventory. You can configure your preferred inventory costing method in your company's accounting settings. This transaction also reduces your inventory asset and records the COGS expense.

What's Next?

Now that you understand the basics of creating invoices and purchase orders: