Bank Statement Import & Reconciliation

Video Tutorial

For a visual walkthrough, watch our step-by-step guide:

Video 1: Complete bank statement import process

Overview

The Bank Statement Import feature allows users to:

- Upload electronic bank statements

- Automatically match transactions with book entries

- Reconcile discrepancies directly in the system

- Maintain accurate cash flow records

Step-by-Step Process

1. Prepare Your Bank Statement

- Download the bank statement template (.xlsx) from the import screen

- Ensure your statement includes:

- Transaction dates

- Descriptions

- Reference numbers

- Debit/credit amounts

- Running balance

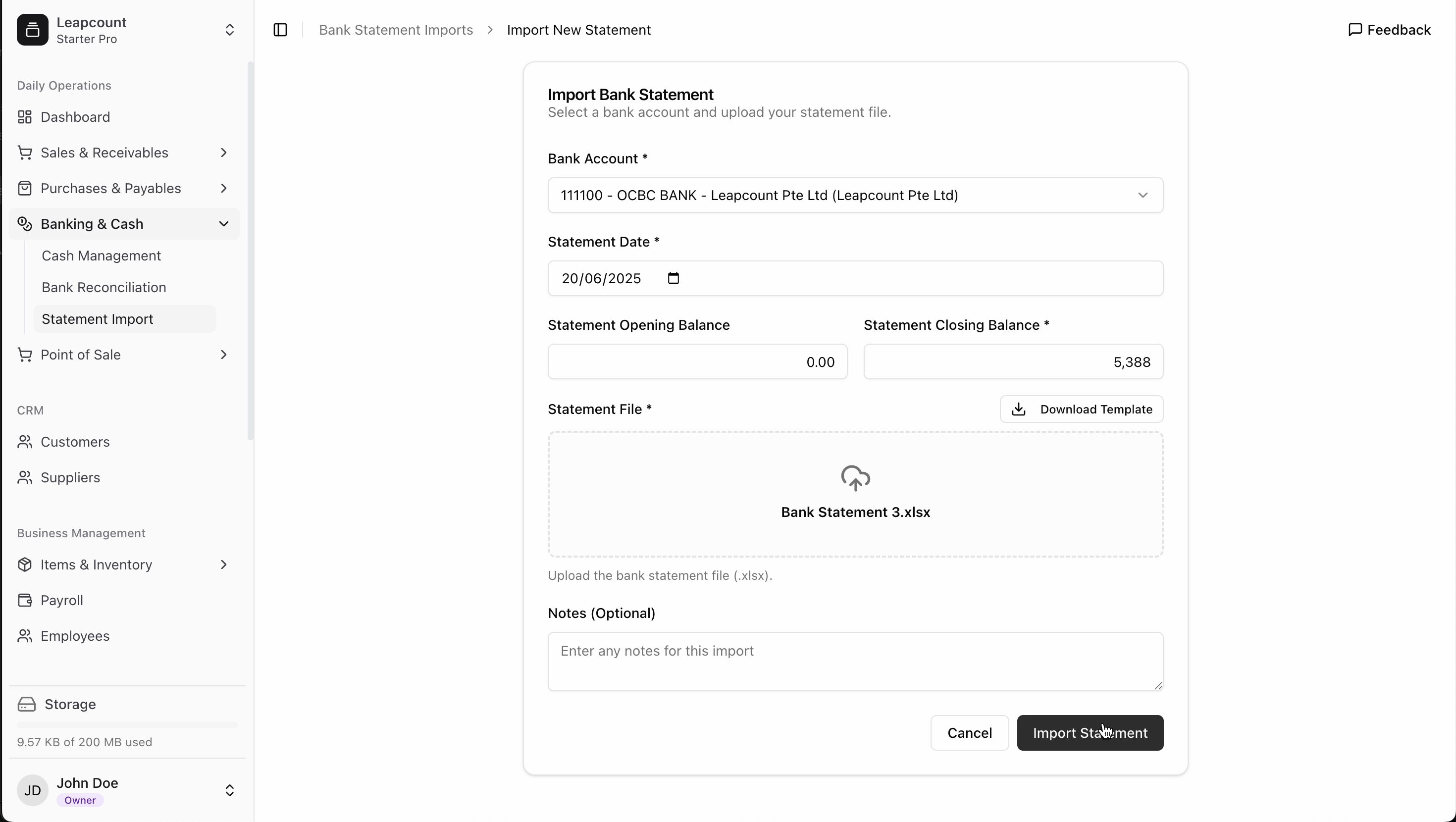

2. Import the Statement

- Navigate to: Banking & Cash → Statement Import

- Select the bank account from dropdown

- Enter statement date (format: DD/MM/YYYY)

- Input opening balance (typically 0.00 for new statements)

- Upload the prepared .xlsx file

- Verify the closing balance matches the last running balance in your file

Reconciliation Workflow

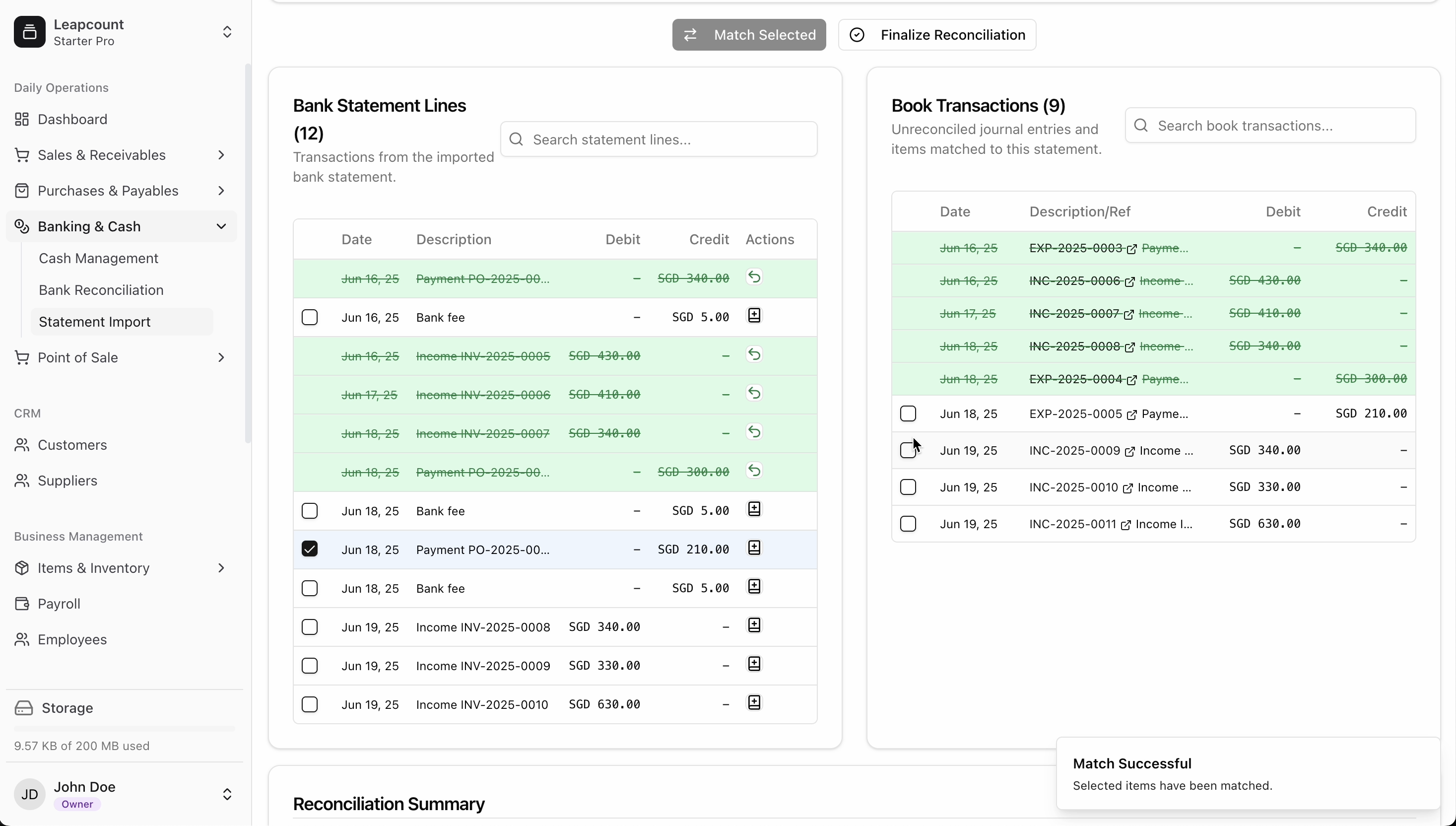

Statement Lines vs Book Transactions

-

The system displays two sections:

- Statement Lines: Transactions from your bank

- Book Transactions: Existing entries in your accounting system

-

Automatic matching occurs when:

- Amounts match exactly

- Reference numbers correspond

- Dates fall within acceptable range

Handling Discrepancies

For unmatched transactions:

-

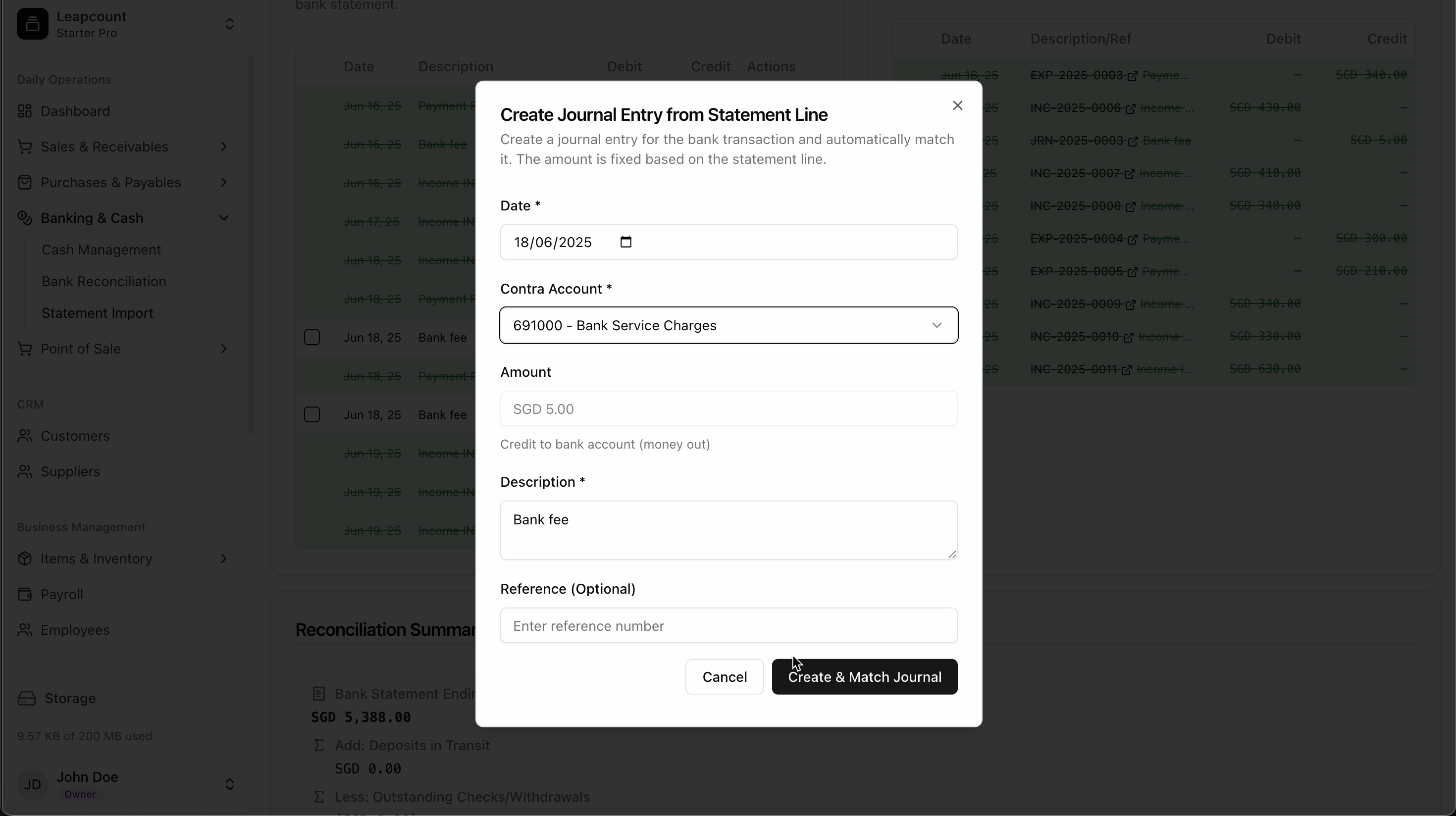

Create Missing Journal Entries:

- Click "+" on statement lines

- Select appropriate accounts:

- Income accounts for deposits

- Expense accounts for withdrawals

- Bank charges account for fees

- Add descriptions and references

-

Correct Book Entries:

- Edit existing entries if amounts differ

- Split transactions if partial matches exist

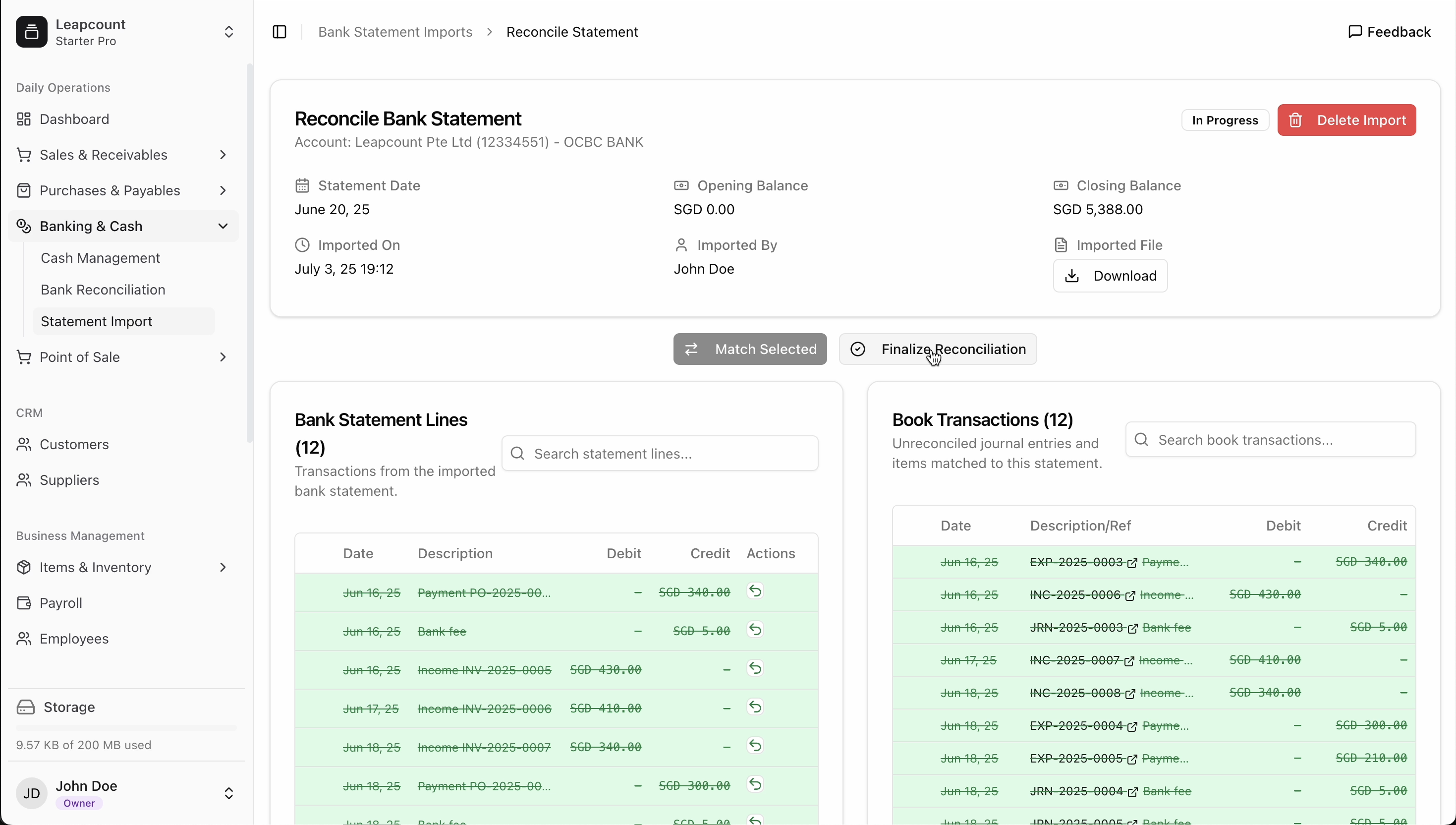

Finalizing Reconciliation

- Verify the Difference field shows SGD 0.00

- Review all matched transactions

- Click Finalize Reconciliation to:

- Lock the statement period

- Generate reconciliation report

- Update account balances

Best Practices

- Frequency: Reconcile weekly to catch errors early

- Documentation: Add notes for unusual transactions

- Verification: Cross-check with physical statements

- Training: Ensure all accounting staff follow the same process