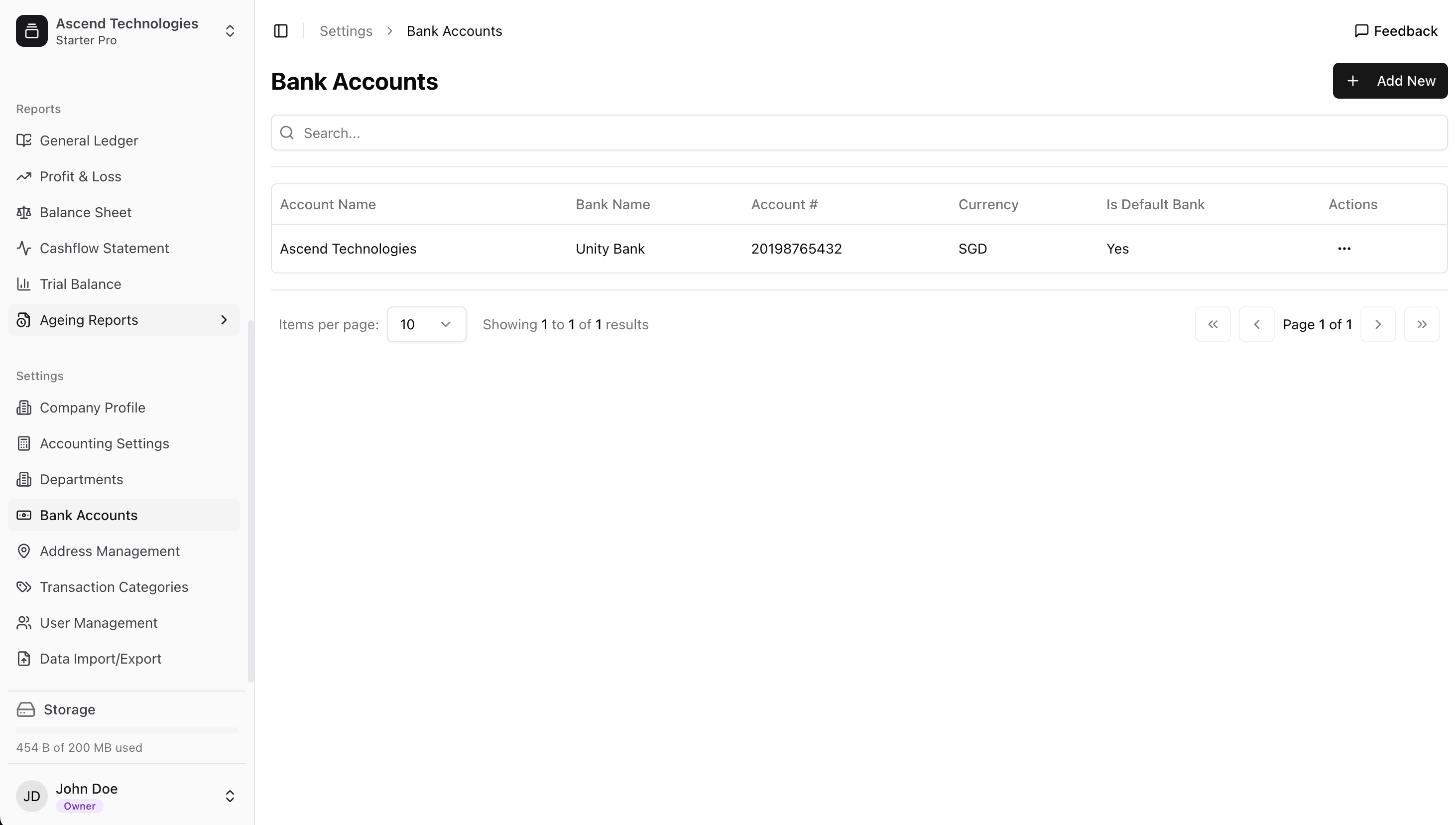

Managing Company Bank Accounts

Properly setting up and managing your company's bank accounts in LeapCount is crucial for accurate financial tracking, reconciliation, and providing payment information to your customers.

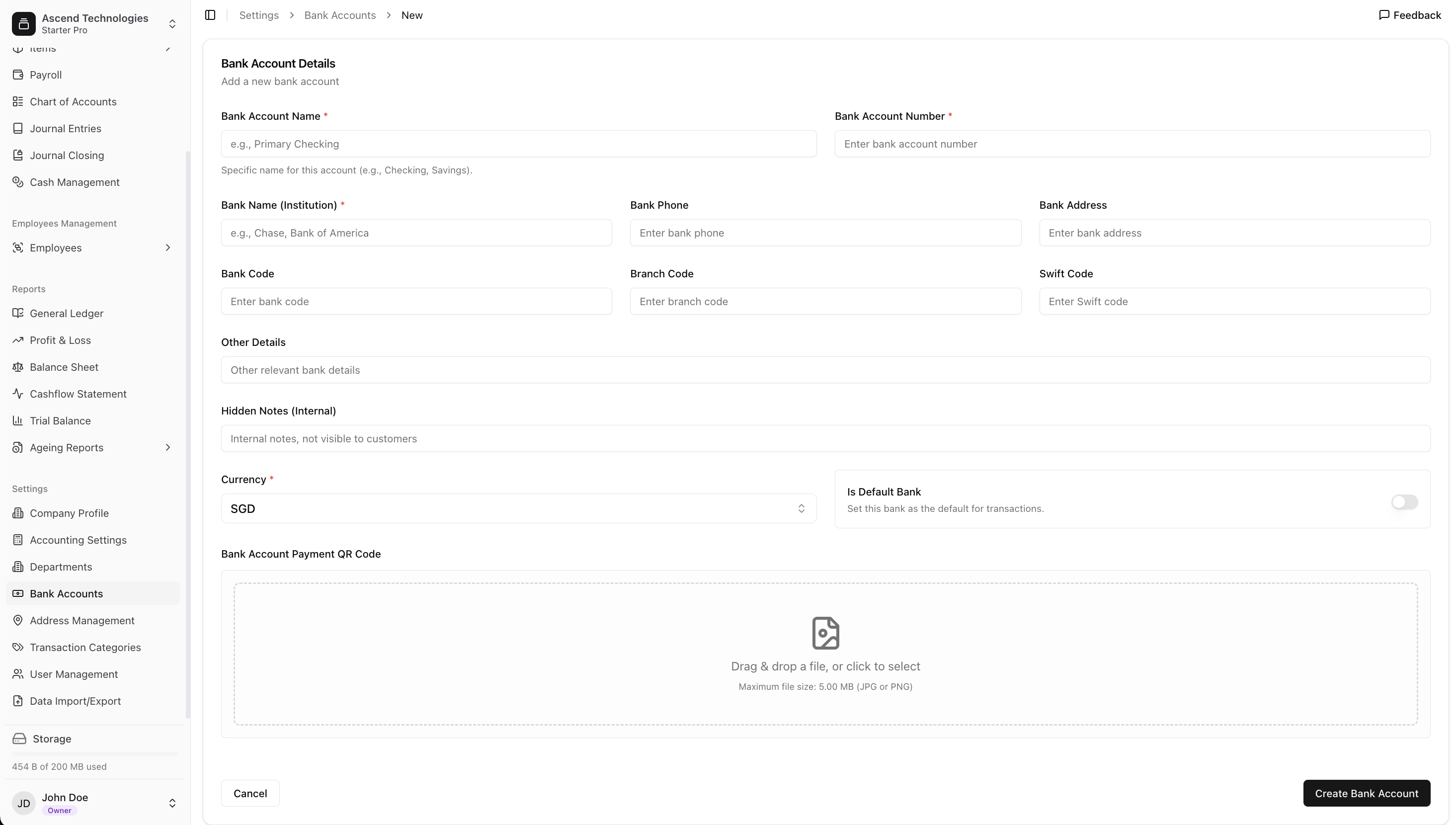

Adding Bank Accounts

You can add multiple bank accounts that your company uses. For each bank account, you'll typically record details such as:

- Bank Name: The name of the financial institution.

- Account Name: A descriptive name for the account (e.g., "Primary Checking," "Savings Account," "USD Operations").

- Account Number: The unique identifier for your bank account.

- Routing Number / Sort Code / IBAN / SWIFT Code: Relevant banking codes for domestic and international transactions.

- Currency: The currency in which the account is held.

- Account Type: (e.g., Checking, Savings).

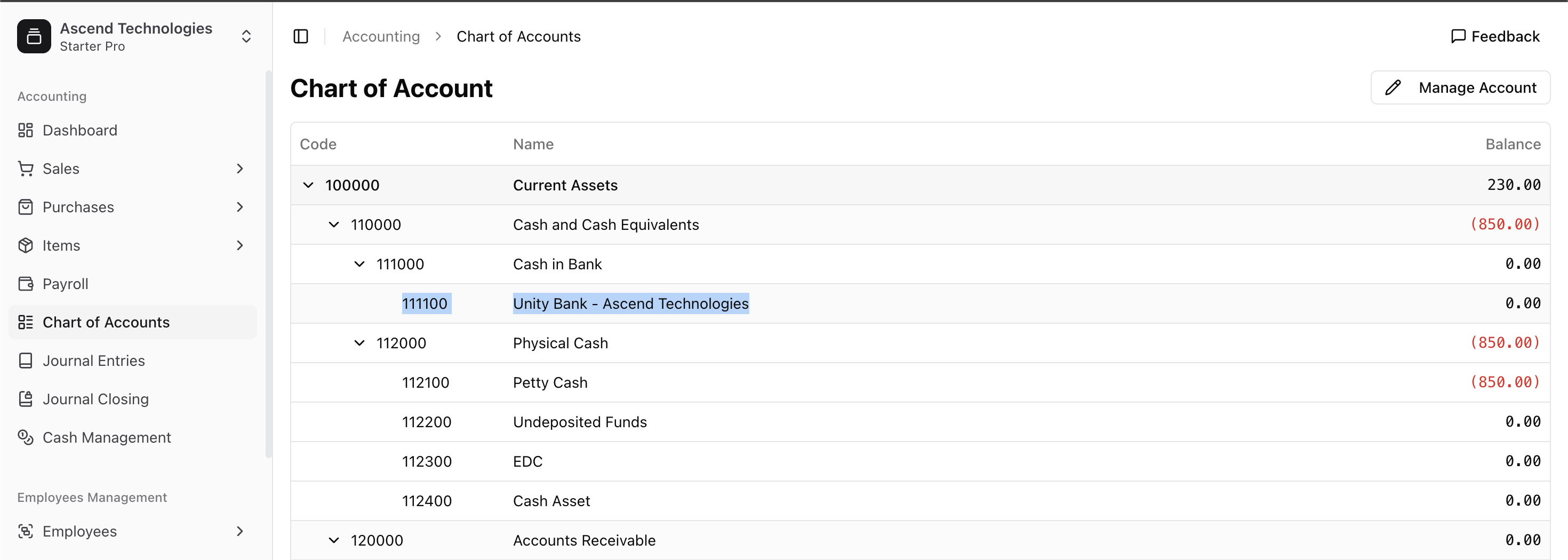

Automatic Chart of Accounts Integration

When you create a new bank account in LeapCount, the system automatically adds this bank account as a new asset account in your Chart of Accounts. This is essential because:

- It allows you to track the balance of the bank account directly within your accounting system.

- Transactions involving this bank account (e.g., payments received, expenses paid) will be recorded against this specific account in your general ledger.

- It facilitates bank reconciliation processes.

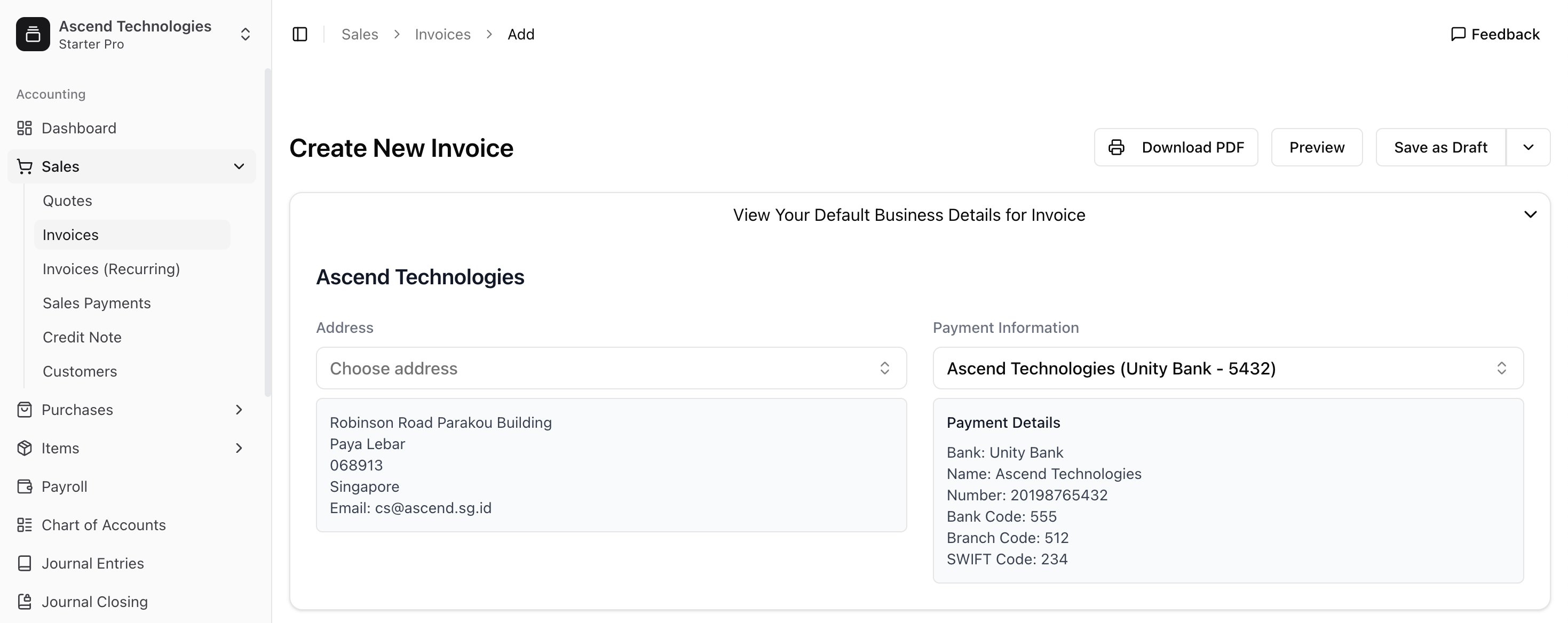

Use on Invoices for Payment Information

You can choose to display details of one of your company bank accounts on your sales invoices. This provides your customers with the necessary information to make payments directly to your account (e.g., via bank transfer).

- Selecting a Bank Account for an Invoice: When creating or customizing an invoice template, you can typically select which bank account's details should be shown.

- Information Displayed: Commonly, the bank name, account number, and relevant routing/SWIFT codes are included.

If you change the bank account details you want to display on invoices, remember this change applies to new invoices. Previously issued invoices will retain the bank information they were created with.

Bank Reconciliation

Having your bank accounts set up in LeapCount is the first step towards performing bank reconciliations. This process involves comparing your internal accounting records of bank transactions against the bank's statement to ensure they match and identify any discrepancies.