Understanding the Chart of Accounts (COA)

The Chart of Accounts (COA) is a fundamental financial organizational tool that provides a complete listing of every account in your general ledger. It acts as the backbone for your accounting system by categorizing all financial transactions into primary types: Assets, Liabilities, Equity, Revenue, and Expenses.

A well-organized COA is crucial for accurate bookkeeping and insightful financial reporting.

LeapCount COA Modes

LeapCount offers two distinct modes for managing your Chart of Accounts, catering to different user needs and accounting complexities:

1. Simple Mode (Managed COA)

In Simple Mode, LeapCount provides a pre-defined, standardized Chart of Accounts.

- Best for: Users who prefer a straightforward, ready-to-use accounting setup. Small businesses or those new to accounting often find this mode ideal.

- Features:

- LeapCount manages the core structure, ensuring compliance and best practices.

- The framework is simplified, but you can still add certain necessary operational accounts.

- Benefit: Reduces the complexity of setup and maintenance, allowing you to focus on your business while ensuring your accounting is sound.

2. Full Accounting Mode (Full Control)

Full Accounting Mode grants you complete control over your Chart of Accounts.

- Best for: Businesses with specific accounting needs, accountants, or users migrating from another system with an established COA.

- Features:

- Full flexibility to create, edit, delete, and structure accounts at any level.

- Ability to define custom numbering systems and account hierarchies.

- Benefit: Offers maximum flexibility to build a COA that perfectly mirrors your financial operations and reporting standards.

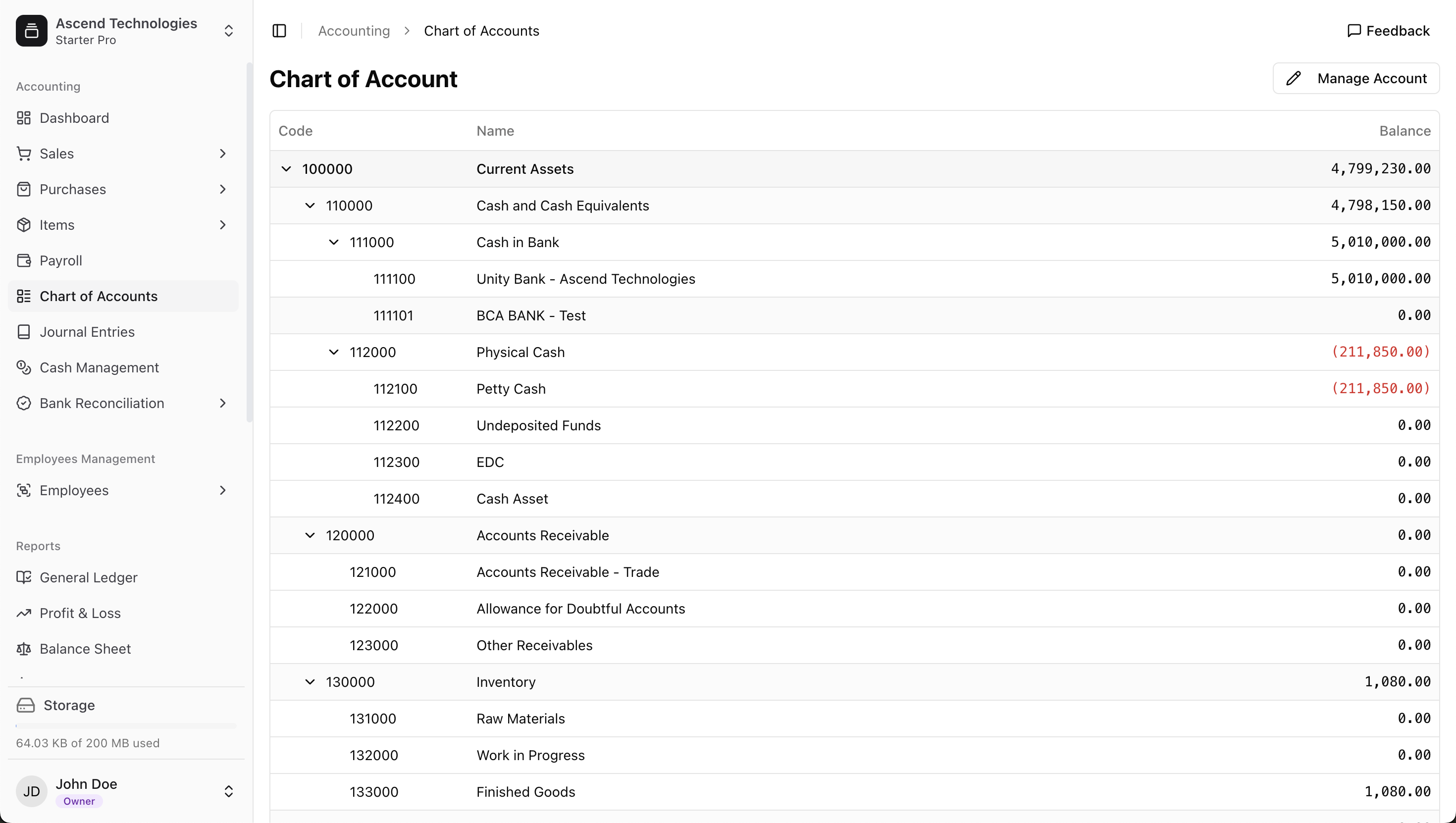

Reading and Navigating the COA Screen

The main COA screen gives you a comprehensive, real-time overview of all your accounts and their balances.

Here’s a breakdown of what you're seeing on the screen:

- Hierarchical Structure: The COA is organized in a tree-like structure with expandable parent accounts (e.g.,

Current Assets) and more specific child accounts (e.g.,Cash in Bank). - Code: A unique number that organizes the list and serves as a shorthand identifier.

- Name: The descriptive name for the account (e.g., "Accounts Receivable - Trade").

- Balance: The current, real-time balance of the account. Note that balances in parentheses, like

(211,850.00), represent credit values or negative balances, a standard accounting practice.

Managing Your Accounts (Full Accounting Mode)

In Full Accounting mode, you have complete control. From the top right of the page, click the Manage Account button to perform key actions:

- Adding a New Account: Create new accounts as your business grows, defining their code, name, type, and parent account.

- Editing an Account: Modify the details of an existing account.

- Archiving or Deleting an Account: If an account is no longer needed, you can archive or delete it. Important: You generally cannot delete an account that has transactions recorded against it. Archiving is often the safer option.

Switching between Simple and Full Accounting modes may have implications for your existing data. It's generally recommended to choose a mode from the outset. If you need to switch, consult LeapCount support or your accounting professional.

What's Next?

- Configure Your Accounting Settings to automate your bookkeeping.

- Understand how transactions are recorded in Managing Journals.

- See how your COA impacts the Balance Sheet and Profit & Loss reports.